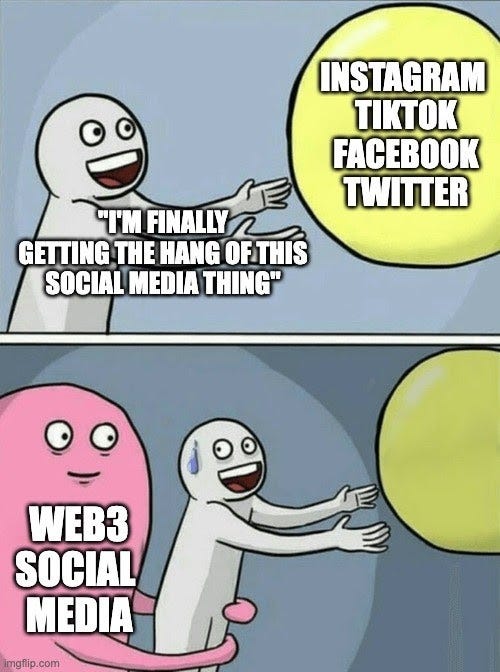

Issue #3: Decentralised social media

Happy Monday and a big welcome to the 58 new subscribers who have joined us since last week's issue.

What's coming up below:

The first decentralised social platforms are now a reality, so how can you take part?

Claws out over CC0: what the latest debate over IP and licensing means for you as a marketer.

A brief, jargon-free explanation of the upcoming Ethereum merge and how it'll impact you.

1. Decentralised social is here

Imagine a social media world where you own your online identity. Where you own your own content, rather than gifting your IP to Meta every time you create an Instagram Reel. Where you can earn money from your content, rather than your content earning advertising revenue for Google. Or Meta. Or Bytedance (TikTok's owner).

This is exactly what Lens set out to do when they built the Lens Protocol—a composable and decentralised social graph. In plain English? It's a social network that nobody owns and anybody can build upon.

In practical terms, this means your one Lens handle can be used across any social platforms that are built on the Lens Protocol. It means that any content you post to one platform is also visible on the others. It means that if someone follows you on one platform, they follow you on all of them.

And all of this? It means you're not locked into one platform simply because you've built an audience and created your content there. You can up and leave at any time if you decide you no longer like it, or if the platform changes its algorithm and starts forcing you to create video content (*cough* Instagram *cough*).

Right now, it's a little tricky to get a Lens handle because they're still in the sunrise period, which ends within the next two days. If you're a trademark holder, you can apply before 16 August to reserve your handle (instructions here). I got mine on Friday

What this all means for you: It's probably not going to overtake Instagram or Tiktok this year, but it's worth claiming your brand/trademark handle early. Keep an eye on their Twitter as they'll announce when handles are publicly available—which might be soon after the sunrise period ends this week.

2. Would you like IP rights with that?

When someone first learns about NFTs, their first question is usually, "but can't you just right-click and save the image?", and the answer is usually, “yes, but you own the original”.

And owning the original often means you have the exclusive right to use it however you want. Let's look at Bored Ape Yacht Club, for example. A $150,000 investment (as at the time of writing) will grant you—and you alone—the right to use your ape character in any way you wish. Owners of these NFTs have turned their characters into merch, TV shows, books and even a burger restaurant.

Intellectual property rights might not be the sexiest dinner table conversation, but it has the web3 world buzzing at the moment. A popular NFT collection, Moonbirds, recently rescinded its owners' exclusive rights, moving all the artwork to a CC0 license—meaning the artwork is now in the public domain and can be used, remixed and commercialised by anyone.

Sounds like a bait-and-switch, right? It’s a little more complicated than it seems on the surface. The argument for making the artwork CC0 is that more people will use the branding in their projects—commercial and otherwise—raising the overall brand profile and pushing NFT prices up as a result.

Investors weren’t so convinced, with Moonbirds prices dropping 3 ETH (about $6,000) after the announcement.

What this means for you: If your brand is launching an NFT collection, licensing rights are something you’ll need to consider in advance.

If you're not planning to launch an NFT collection, this is still relevant to you. It’s worth looking at NFT artwork that is already in the public domain (i.e. projects with a CC0 license) and exploring how you can use or remix them in your own projects.

3. The Ethereum merge is happening

If you've spent any time in the web3 world lately, you'll know that the Ethereum merge is finally scheduled to go ahead. It's all anyone can talk about.

In around a month's time, the Ethereum blockchain will become more efficient, more secure and more environmentally friendly by changing the way it validates transactions.

Currently, every transaction that happens on the Ethereum blockchain is validated and turned into a “block” using a mechanism called proof of work (PoW). Bitcoin uses this method too. You may have heard of the term “Bitcoin mining” before, which is where a whole bunch of really high-powered computers all race to solve a mathematical problem and be the first to validate a transaction. All so they can earn some Bitcoin as a reward.

But Bitcoin is slow. It can only process 7 transactions per second. Right now, pre merge, Ethereum can process around 20 transactions per second. Visa, on the other hand, can handle 65,000 transactions per second.

The other problem with PoW is that it requires a lot of computing power and electricity, making it about as environmentally friendly as Elon Musk’s private jet.

The merge is when the Ethereum blockchain will officially move from PoW to proof of stake (PoS). This method validates transactions by having Eth holders stake their tokens, in return giving them the chance to be chosen as a validator for the transaction.

This method uses a fraction of the computing power, processes more transactions per second and is more secure.

What this means for you: You don't need to do anything—if it all goes to plan, it should feel like business as usual. But this big move will overcome some of the criticisms about Ethereum and could lead to greater adoption.

If you've made it all the way down here, that means either you found this interesting, or you're on your way to the unsubscribe button at the bottom.

Either way, I'd love it if you could please take 2 minutes to let me know how I'm doing. What would you like to see more of? Less of?

Until next week,

Steph

PS. Did someone forward you this email? Click here to get the weekly emails straight to your inbox, minus the middleman.

This should go without saying, but I am a marketer, not a financial advisor. The content in this email is for educational purposes only and should not be taken as financial advice. Please take care and do your own research before investing in any web3 projects.